us exit tax percentage

Tax Administration July Adverse Weather Event. Being a covered expatriate complicates expatriation.

Exit Tax Us After Renouncing Citizenship Americans Overseas

Expatriation from the United States.

. The IRS requires certain expats to calculate an exit tax when they exit the US and file their 10401040NR tax return along. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. Citizen who relinquishes his or her citizenship and 2 any long - term resident of the United States who ceases to be a lawful.

Exit taxes can be imposed on individuals who relocate. What is expatriation tax. Legal Permanent Residents is complex.

The rate of Exit Tax is 125. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is.

What is the US exit tax rate. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Your average net income tax liability from the past five years is over.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up. For eligible plans US expatriates may be subject to a 30 US tax rate on all taxable payments which is to be deducted and withheld by the payor. 6 NovemberDecember 2020 Pg 60 Gary Forster and J.

The current rules came into effect in respect of events which occurred on or after 10 October 2018. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. The purpose of the transaction is to ensure.

Green Card Exit Tax 8 Years Tax Implications at Surrender. Green Card Exit Tax 8 Years. The IRS Green Card Exit Tax 8 Years rules involving US.

Currently net capital gains can be taxed as high as. The term expatriate means 1 any US. Citizens who have renounced their.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market. Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country.

How To Invest In Share Market In India An Ultimate Beginner S Guide Investing In Shares Investing Share Market

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Exit Tax In The Us Everything You Need To Know If You Re Moving

What Are The Us Exit Tax Requirements New 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Us Investors Continued To Exit Equity Mutual Funds In 2012 December 26th 2012 Mutuals Funds Equity Investors

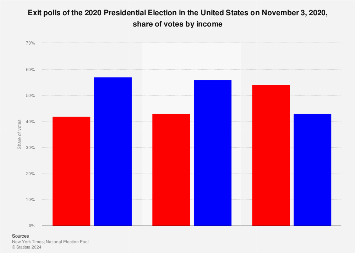

2020 Presidential Election Exit Polls Share Of Votes By Income U S 2020 Statista

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Renounce U S Here S How Irs Computes Exit Tax

What Are The Us Exit Tax Requirements New 2022

Us Exit Taxes The Price Of Renouncing Your Citizenship

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

Exit Tax In The Us Everything You Need To Know If You Re Moving